Banking on Our Youth

A program for financial literacy

The Banking on Our Youth program opens the gate to financial literacy for high school students in Orange County.

“Financial Literacy” is an uncommon term that most students likely haven’t heard of. Financial literacy is the possession of knowledge in relation to finances; such knowledge can be related to, but not limited to economic decisions, awareness of credit, or knowing how banks work. In an article titled, “Financial Literacy,” Jason Fernando defines financial literacy, its significance, and more.

“Financial literacy is the ability to understand and effectively use various financial skills … Financial literacy is the foundation of your relationship with money, and it is a lifelong journey of learning. The earlier you start, the better off you will be” said Fernando.

Fernando’s argument explains why financial literacy is vital to monetary success. He defines financial literacy to be the foundation of anyone’s “relationship” with money. As stated in Fernando’s argument, anyone without financial literacy would fail to use their money effectively, especially in the long term. According to Possible, a financial resource, most Americans aren’t financially literate. This is proven by Cheng Fu, in their article, “32 Must-Know Financial Literacy Statistics in 2021.”

Fu stated the following statistics: “Worldwide, only one-third of adults understand basic financial concepts. Four in seven Americans are financially illiterate”.

Despite the importance of financial illiteracy, only a minuscule number of schools are catching onto the trend to educate their students on the vital topic. Fu goes on to provide another statistic that supports this claim:

“In 2020, states that required high school students to take a personal finance course increased by 24 percent from 2018,” said Fu.

Out of thousands of high schools, only 24 percent have caught on to the trend in two years. According to Maya Riser-Kositsky’s article, “Education Statistics: Facts About American Schools,” we learn that there are 21,497 public high schools in the United States as of 2019.

As proven by Fernando and his claims, financial literacy is vital to success with money. Without this education young individuals can only expect to fail from economic challenges they’ll evidently face in life. A bad foundation can make everything afterward become even more challenging. This lack of financial literacy can result in poverty and struggling families or individuals.

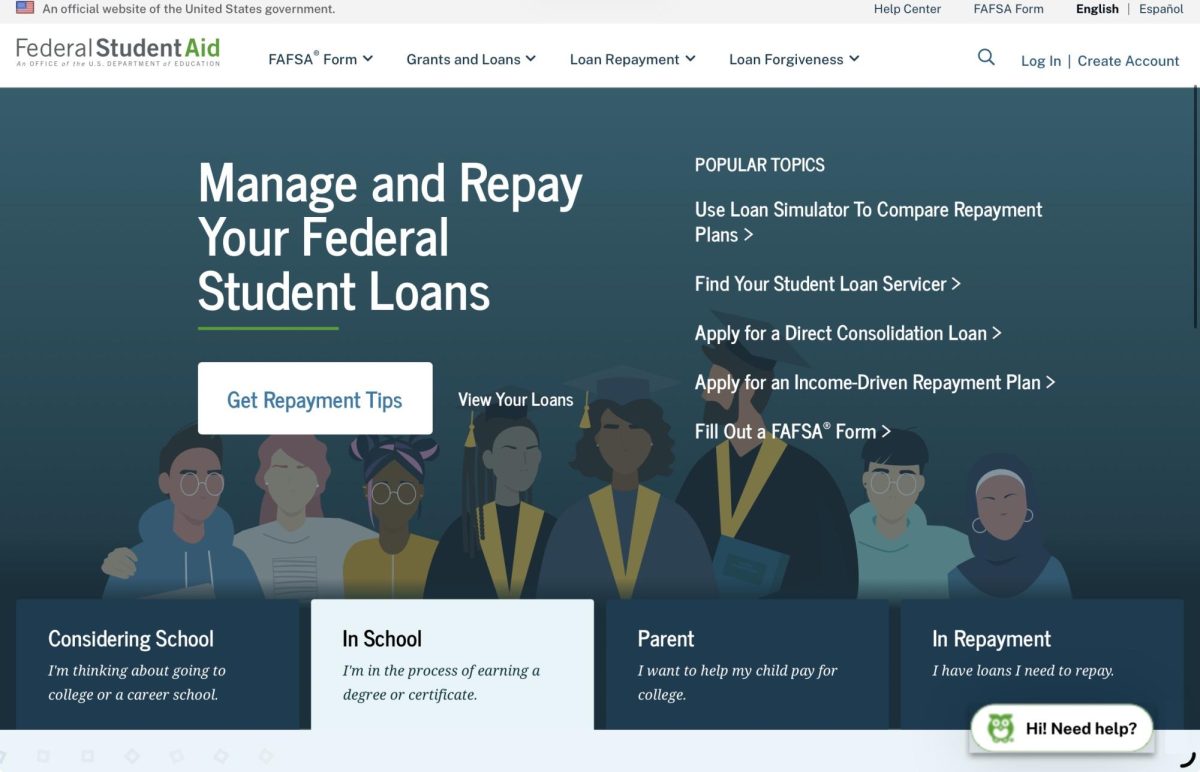

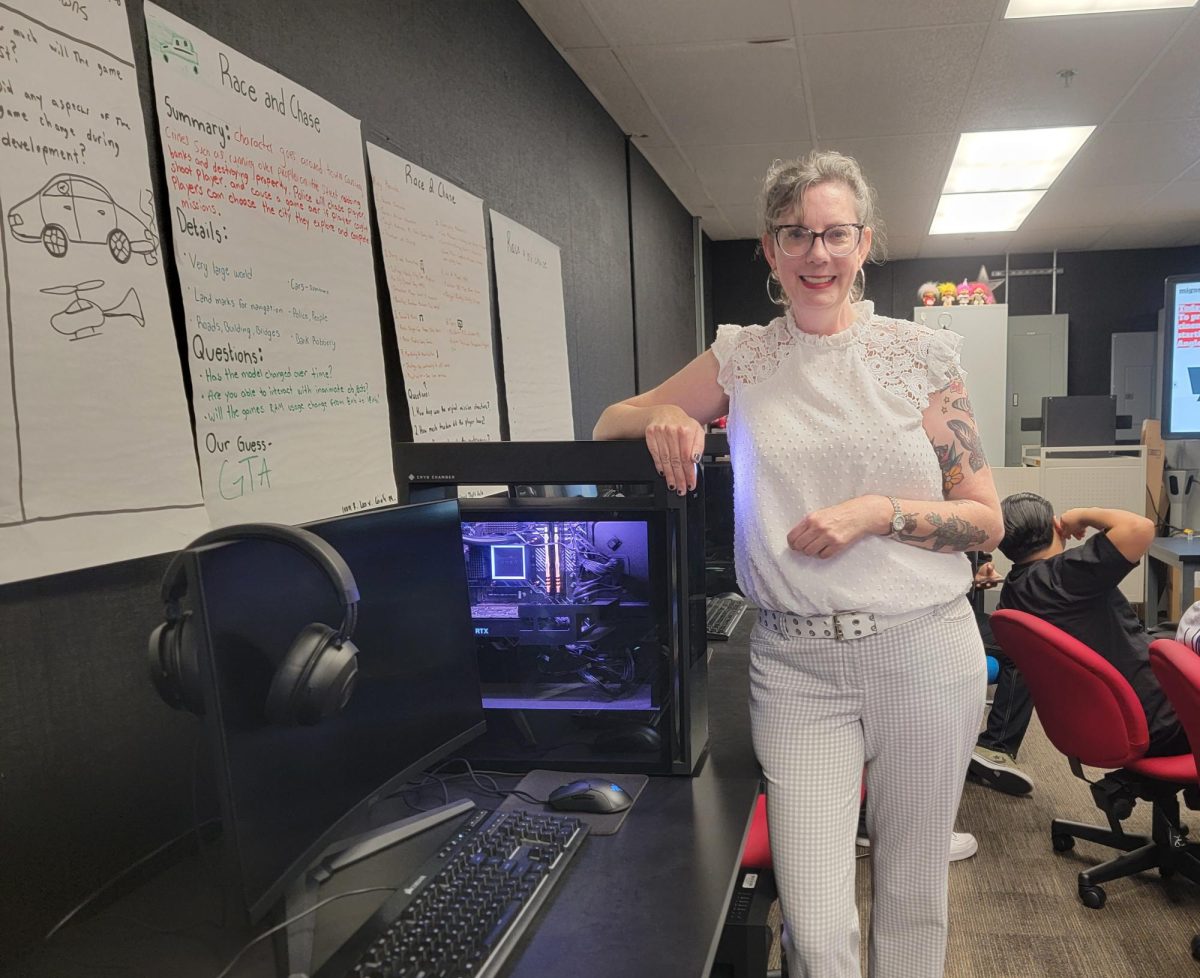

Banking on Our Youth is a local program in Orange County, California, led by Templo Calvario. The program is taking on the challenge of financial literacy absence by educating young students on the topic. It connects high school seniors and juniors with resources that will allow them to grow and become independent economically. Additionally, to be given the best chances of success students of the program participate in lectures from guest speakers within a career in finances.

Director of Sales and Marketing for Medical Devices, Randall Bergstedt said, “It’s great to see high schoolers give up 3-4 hours of their Saturday to learn about entrepreneurship.” Bergstedt is a mentor in the BOY program and works with students to create a business plan that is later pitched to other businesspeople for a chance at winning a scholarship. For two out of the three years he has been a mentor, Bergstadt has successfully assisted students in earning a scholarship through a competition all students take part in.

Director of Accounting for FirstService Residential and one of the largest property managers in North America, Luis Juarez stated, “I didn’t have something like this growing up myself, I went into business and didn’t have any guidance. When I heard about this, I was like this is it. Someone mentioned this being part of the high school curriculum, I think that’s awesome.”

Juarez is another mentor which students of the program have the privilege of working with to create a business plan for the scholarship competition held at the end of the program. Similar to Juarez, many believe that including financial literacy into the educational curriculum nationwide would benefit students once they graduate high school.

As a member of the BOY program, I have had the opportunity to meet like-minded individuals who also believe in an education of financial literacy. I have been educated by professionals in the field of finances with the use of lectures, activities, and real-life examples. Additionally, I have had the space to grow as a person by inquiring about financial subjects without the fear of being judged. Everyone is in the room to learn and everyone respects where their peers are in the learning process, as well as their financial background.

It is important to keep in mind that all students will at some point face economic and financial challenges. By educating students on the subject at a young age, most of those hardships can become minuscule. With the proper understanding of finances, all students can succeed and overcome such challenges independently. The BOY Program stands out among extracurricular activities as a pioneer to help students prepare for more than just college; it prepares them for life.

I love rain, I love cold weather with a cozy setting, and I want to learn multiple languages.