Reducing the number of questions, increasing the number of schools, lowering the minimum Student Aid Index number and the need for all contributors to create a Federal Student ID are some of the major changes that come with the new Free Application for Federal Student Aid application for 2024-2025.

The U.S. Congress passed the FAFSA Simplification Act in 2020, in which many changes had to be made to the prior application. The ultimate objective of the adjustments was to simplify the application process and make it available to more individuals.

But is it really a simplification? Or is it not just more complex, but an actual mess?

High school counselor, Janet Montes, shares how the new simplification of the application process does not have as many workarounds as the previous years.

“There have been hurdles that some students have to overcome. If it is streamlined, it’s much better than previous years, as if it was as accessible, and had many work-arounds as there was last year,” Montes said. “Like when we would run into issues last year, there would always be a solution available.”

As previously mentioned, one of the crucial changes that was made is the need for all contributors to create an FSA ID for the student to be able to submit their financial aid application.

According to NerdWallet, a personal finance company that helps guide individuals to make smart money choices states that “this could include the student, the student’s spouse, one or both biological or adoptive parents, or the parent’s spouse.”

This leaves room for issues to be encountered.

“From the student’s perspective it seems easier. It is from the parent’s perspective, not mattering what their status is, where it becomes difficult,” Montes said.

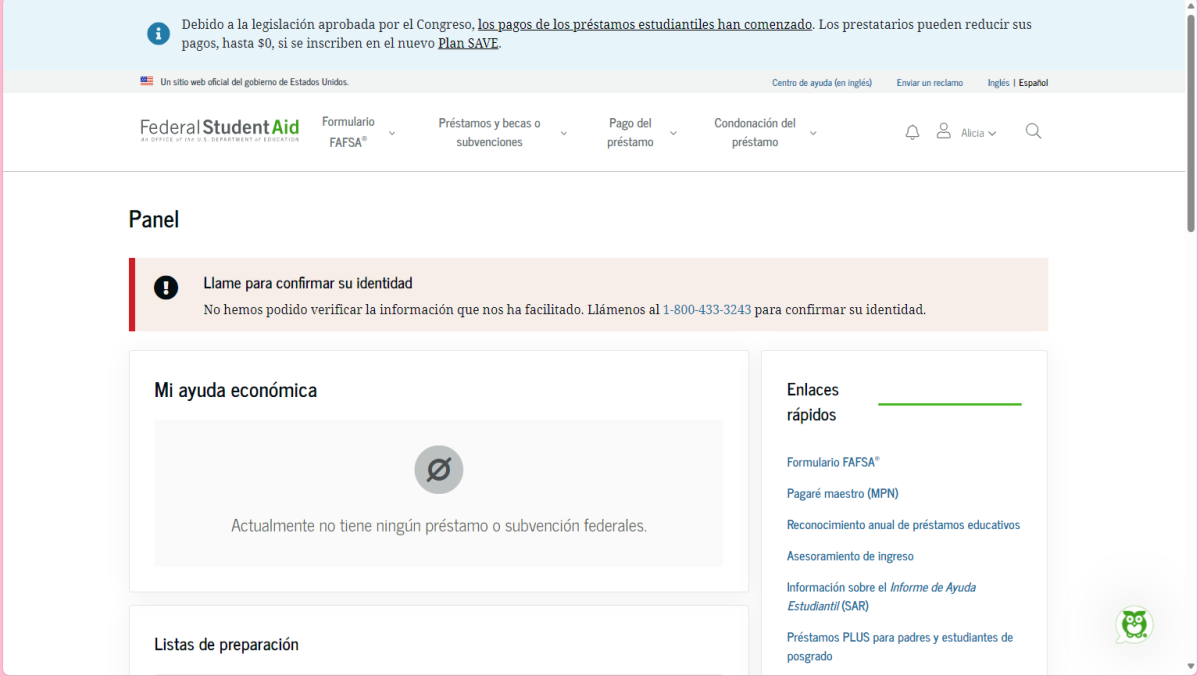

Alicia Gomez, a parent without a Social Security Number, has not been able to complete her portion of the application.

The following quote has been translated for clarification.

“At first I couldn’t even create my [FSA ID] account. When I called I would wait about two hours just for them to hang up or say that there is still no solution. When I finally created it, they told me that I had to send some documents to verify my identity. I sent them about two weeks ago and they just sent me another email that I have to call again,” Gomez said.

Another main adjustment that was made was the minimization of the number of questions that had to be answered throughout the entire application. This allowed students to complete the application in a small amount of time.

In previous years, students had to answer approximately more than 100 questions, whereas now, students only have to answer around 30 to 36 questions on the form.

Senior Daisy Barragan, whose contributor has a Social Security Number, has already submitted her financial aid application and shares her thoughts on the quick application process.

“It took me, I think, max 30 minutes. And, I didn’t have to call,” Barragan said. “The questions themselves felt like they were too vague. It was too easy to be done.”

After going through the entirety of the application process, Barragan shares her thoughts on the new process.

“I feel like this whole new system was meant with good intentions but it turned out to be such a pain. I feel like we are depending on one system far too much when we all know that system is very complicated to begin with,” Barragan said.

However, those who have contributors who are having issues with their portion of the application have been having to wait longer periods and have still not been able to submit their applications.

In previous years, the FAFSA application was available to students beginning October 1. But, during this new cycle, the application only became available on December 31 and came with many systemic glitches that wouldn’t allow students to complete their application that same day.

Due to the late start, some institutes have accommodated their financial aid submission dates and have extended the deadline.

According to FAFSA, “for state financial aid programs, submit your application no later than April 2, 2024.”

But to make an informed decision when committing to a college, the University of California system encourages students to submit their financial aid application by March 2. Likewise, this is the same deadline for most California State University schools.

Cal State Fullerton has further extended the priority deadline to April 2. On the contrary, private schools have still kept the same deadline as in prior years, even though the financial aid application opened at a much later time.

All that is left is to be patient with this new system.

“If we hurry and always do things without being careful, we may need to deal with greater consequences. So I have to remind myself to remain patient and hope for the best with this system,” Gomez said.